The creation of long-term value for the Group depends on our ability to meet stakeholder needs.

We therefore carry out an annual materiality analysis to make sure we gather and take into account feedback on bank industry topics from a variety of stakeholder sources. This process helps us to identify and address the issues that are most material to stakeholders, including emerging risks.

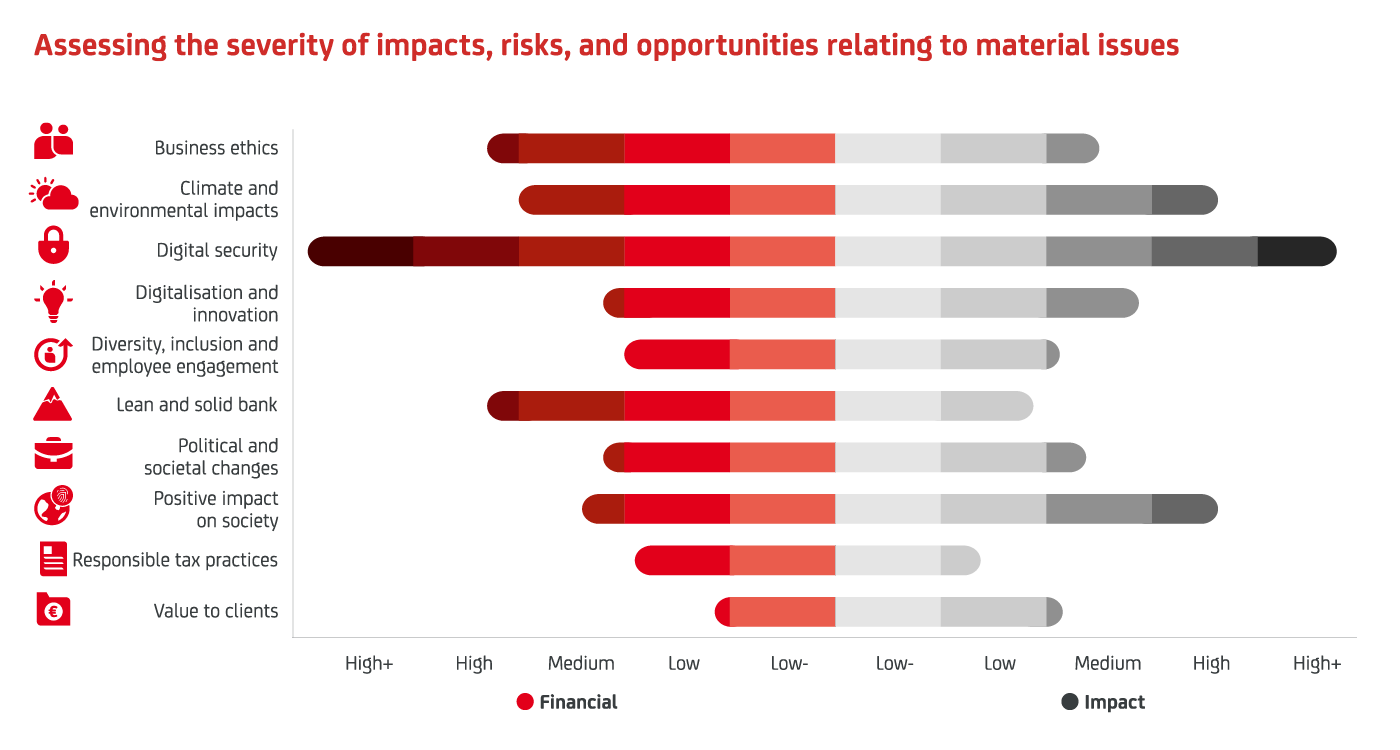

During 2023, our impact materiality assessment set out our progress toward implementing the 2021 GRI Standards Update. This update guides how we report sustainability information and is helping us modify our analysis to pave the way for the introduction of the new Corporate Sustainability Reporting Directive (CSRD). We have assessed sustainability impacts, risks, and opportunities (IRO) across the environmental, social, and governance matters deemed to be material from a double materiality perspective: impact materiality and financial materiality. For each material topic, we have identified the related impacts, risks, and opportunities – based on our activities and business relationships, the context in which these take place, and our understanding of the stakeholders most affected.

The materiality tornado chart, shown below, is a key result of this year’s materiality analysis. The chart is a graphic representation of the process of identifying and prioritising material issues by assessing the severity of the impacts, risks, and opportunities related to them, thus applying a double materiality approach: inside-out (actual and potential impacts on each material topic) and outside-in (the impact of each material topic on the Bank’s growth, performance, and position).

Impacts, risks and opportunities

The table of impacts, risks and opportunities, so‑called IRO table, is another key result of this year’s materiality analysis that will inform our focus and priorities.

For each material topic, we identified the actual and the potential positive and negative impacts directly caused by UniCredit’s operations and value chain on people or the environment. This can be seen under ‘Impact materiality’ in the table which can be downloaded below, which covers material information about our impacts on sustainability matters.

The table also outlines risks and opportunities that may cause financial effects – for example, an impact on the Bank’s cash flow, financial performance, and position in the short, medium and long term. This can be seen under “Financial materiality”, which covers material information about risks and opportunities resulting from sustainability matters.