UniCredit Unlocked is a unique strategy which delivers for the present while transforming our bank for the future.

UniCredit Unlocked is aimed at reuniting a network of 13 independent banks into a cohesive pan- European leading entity, leveraging local strengths and harnessing collective capabilities through the centralisation of products and technology.

Despite the continued macro challenges and economic and geopolitical uncertainty since day one of UniCredit Unlocked, we have demonstrated excellent progression and delivered remarkable results in industrial and financial transformation.

The overarching aims of the UniCredit Unlocked plan are to:

Our industrial transformation priorities

1. Empowering and unifying

A common vision, a unifying culture, and a winning mentality: promoting ownership and empowerment

Our approach

Listening as a foundation

Extensive listening to our stakeholders equally to define a bottom up unifying cultureLiving by three values

Set of simple yet powerful values embedded in all we do – Integrity, Ownership and CaringLeading by example with concrete commitment

Living our Culture and ESG principles day by day through a number of initiatives, guided from the Group and proactively proposed by all the colleaguesKey achievements in 2023:

1st

Culture Day ever, involving over 30k colleagues organised in all countries’ banksAA

MSCI improved ESG rating€100m

to close gender pay gap and promote diversity and inclusion

2. Simplifying and delayering

A new way of working, creating a lean, fast and efficient organisation cultivating empowerment within a clear framework

Our approach

Leaner structure

Delayered organisation, tackling visible complexity and unnecessary bureaucracy affecting accountability, daily operations quality and speed, realising significant efficienciesDecisions in the right place

Empowered people to propose and run the change, simplify tasks and improve automation, freeing up time to focus on value added business activitiesActing in a new way

Everyone embracing a new way of working empowered to take ownership and make decisions and supported by a clear risk and compliance frameworkKey achievements in 2023:

400

Employees’ ideas collected turned into 200 simplification actions-30%

Reduction in organisational structures-25%

Simplification of processes based on E2E customer journeys

3. Rationalising and strengthening

Partnerships and procurement leveraging Group scale and bargaining power, to rationalise supplier contracts and build long-lasting Group relationships

Our approach

Rationalise

Mindset that encourages rationalisation of old legacy structures, and equity participations, and leverage Group scale and bargaining power to act in best interest of our clients and realise efficienciesGlobal ecosystem

Building long-lasting Global partnerships and relationships with top industry players to further improve our clients’ journey, choice and to access our partners clientsKey achievements in 2023:

-55%

Rationalisation of insurance partnership (from 9 to 4)3.5m

Clients accessed through Alpha Bank partnership in GreeceNew reinforced partnerships

Allianz, Mastercard, Alpha Bank, Azimut

4. Growing and investing

In our people on the front-line and our distribution channels, in our franchise and building our product factories, to deliver an unmatched and fully-fledged product offering

Our approach

People and franchise

Investing in our people on the front-line and in our distribution channels to deliver the best tailored offering to our clients and cascade client insights to our product factoriesProduct factories

Build up and invest in our factories to deliver an unmatched fully-fledged product offering and to capture capital light growthKey achievements in 2023:

c.30hrs

Training per employee per annum since 2021onemarkets

In-house product factory launched with 21 onemarkets funds issued and almost 4bn already distributed at the end of 2023Built

3 market leading Product Factories: Individual Solutions, Corporate Solutions, Payment Solutions

5. Modernising and enhancing

Digital and data, taking back control of core competencies, streamlining and enhancing our digital organisation, and standardising and modernising our digital technology

Our approach

Take back control

Attracting, engaging, and developing talents through involvement in strategic projects, insourcing key competencies and dedicated learning and developmentRationalise

Streamlining and enhancing our digital organization and operating model, while reducing the sourcing model to curb spendingConverge

Standardise and modernise our infra technology, rationalising the geographical footprint while improving our service qualityKey achievements in 2023:

c.15%

Digital workforce reskilled>1.3k

Tech hirings since 2022c.35%

Lower external daily rates, through reduction of # vendorsOur financial levers

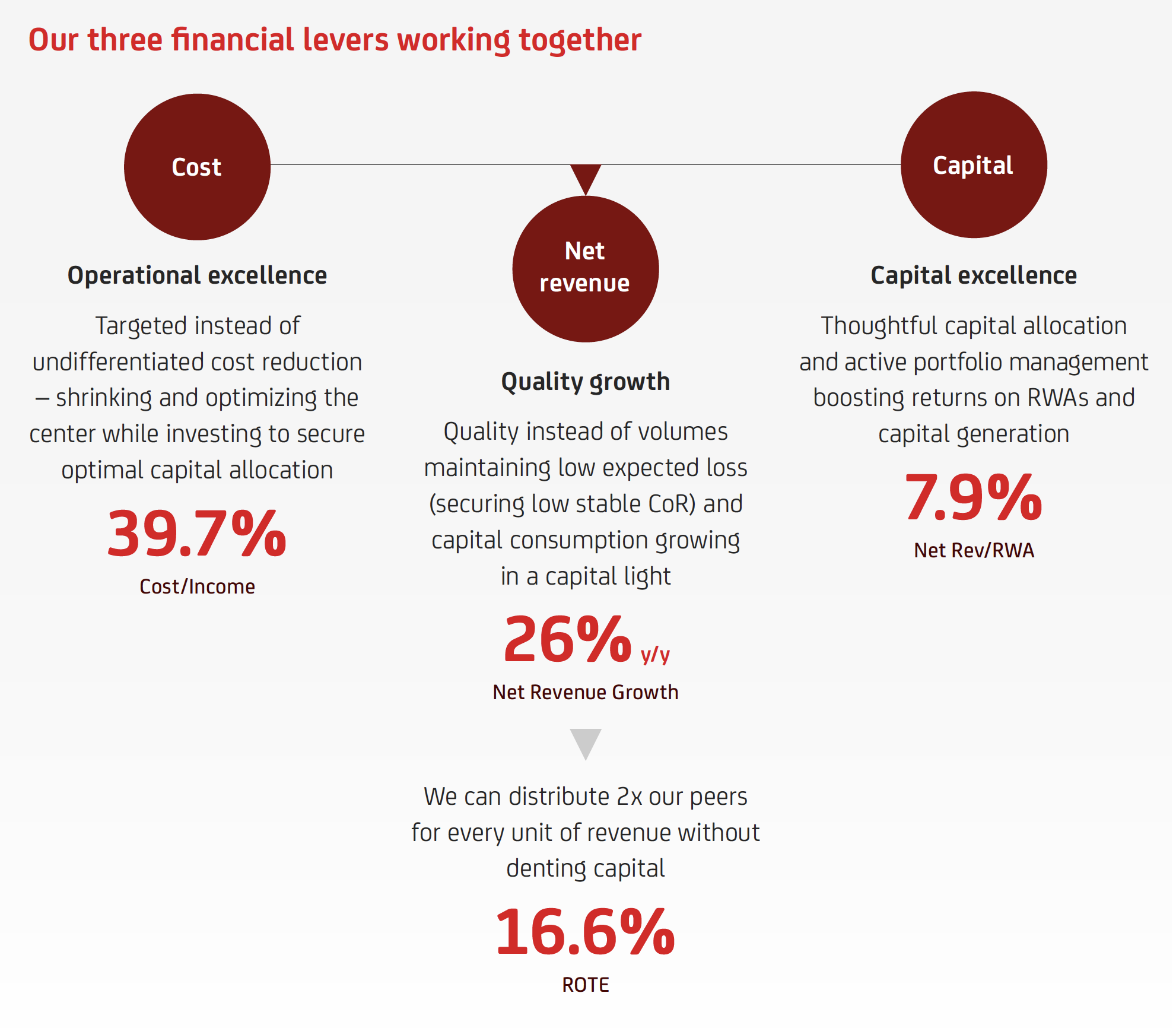

Our industrial transformation is steered by our financial results. Optimising the balance of our three financial levers: Costs, Net Revenues and Capital, underpins our UniCredit Unlocked strategy. The three levers operate to produce superior returns, deliver best in class organic capital generation and a solid balance sheet.