The key trends and issues driving our markets

Macroeconomic context

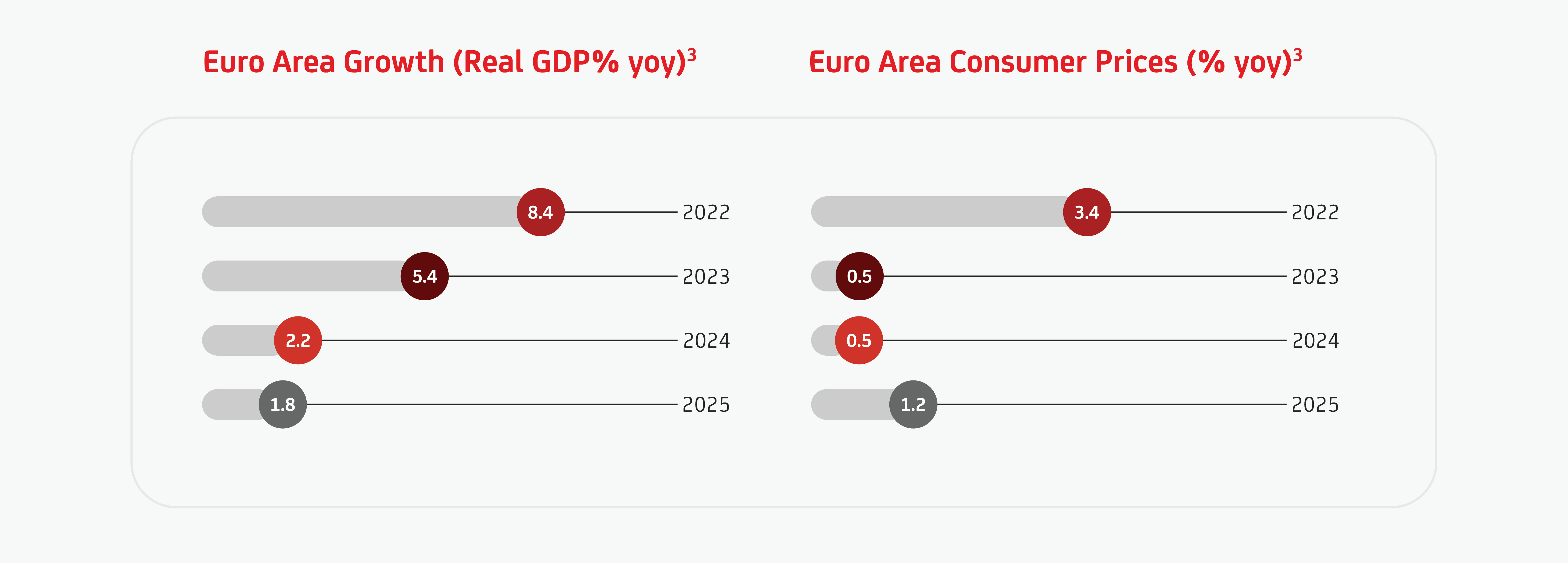

- Economic growth has slowed as central banks’ interest rate hikes gradually filter through to the economy

- The Eurozone is witnessing a significant decline in inflation. Prices for basic consumer goods and food have had the greatest impact on this slowdown

- A tense global geopolitical situation is increasing uncertainty across global financial markets and exacerbating humanitarian repercussions

- At COP28, a historic agreement was reached to transition away from fossil fuels and reach Net Zero emissions globally by 2050

Stakeholders

Consumers

- Globally, 64% of consumers are highly concerned about sustainability, and their worries are mounting 4

- 12% of consumers are willing to pay more for sustainable products4

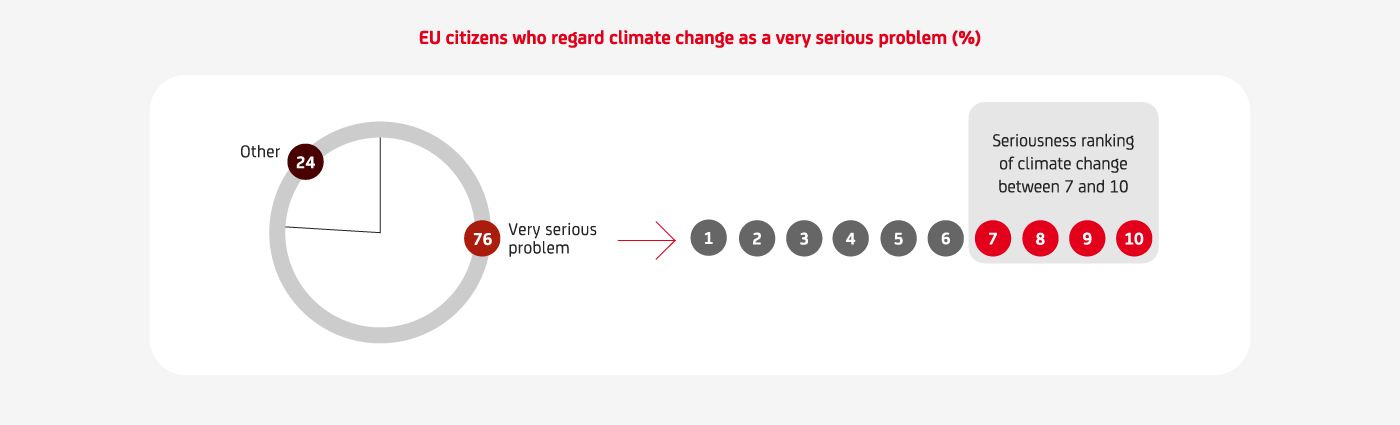

- More than three quarters (77%) of EU citizens regard climate change as a very serious problem, ranking the seriousness of climate change between 7 and 10 on a scale to 105

- Almost 4 in 10 EU citizens say they are personally exposed to environmental and climate-related risks and threats5

Companies

- Companies are broadening their commitments to nature beyond carbon, with 34% of European companies in the Fortune Global 500 having targets for three or more dimensions of nature6

- According to the CDP, Clarity AI latest report on first year EU taxonomy disclosure, of 1,700 NFRD companies that published EU Taxonomy this year, c.600 identified their revenues and spending as part of their transition plans, c.300 have validated science based targets, both of which correlate to higher taxonomy alignment overall

3. Estimates based on UniCredit Research (February 2024).

4. Bain & Company, The Visionary CEO’s Guide to Sustainability, November 2023.

5. European Union, Eurobarometer, Climate Change, July 2023.

6. McKinsey & Company, companies are broadening their commitments to nature beyond carbon, December 2023.

Investors

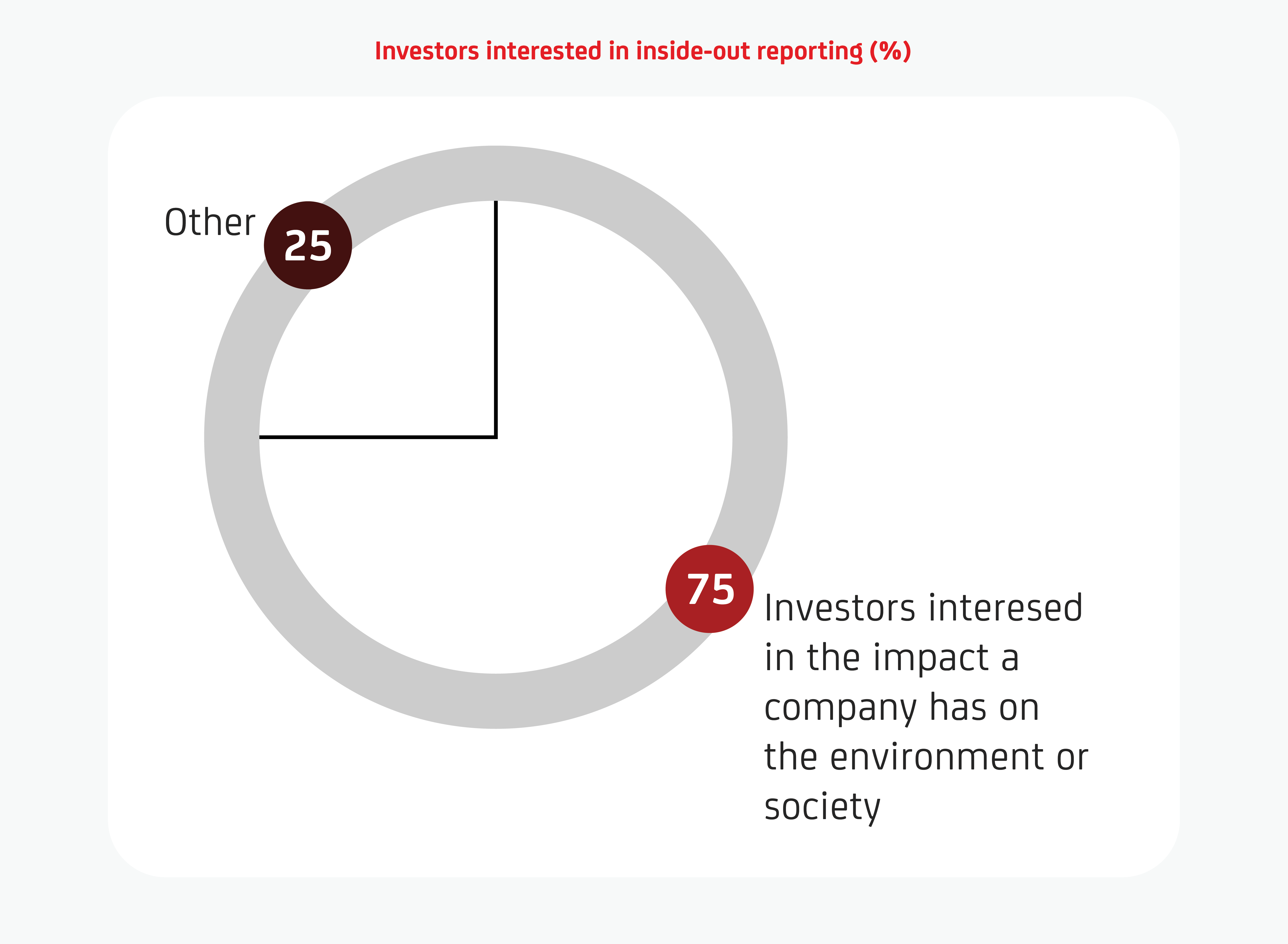

- In addition to their interest in how sustainability affects financial performance (outside-in reporting), 75% of investors want to know about the impact a company has on the environment or society (inside-out reporting)7

- Nature and Biodiversity have started to capture investors’ attention, as evidenced by their desire to identify investment opportunities in nature conservation or ecological-improvement projects. These are becoming increasingly available to private investors through mechanisms such as debt-for-nature swaps and carbon credits8

- Power generation is of particular interest to investors, but all mitigations have strong investor support9. Solar, smart grid technologies and utility-scale storage are among the top three areas for investment

Regulators

Industry trends

- Demand for critical minerals for clean energy technologies is expected to increase rapidly, by three and-a-half times to 2030 in the IEA Net Zero Emissions by 2050 Scenario, which shows demand for critical minerals growing10

- Food and agriculture companies urgently need to raise their ambitions on sustainability and health to build more future-proof and competitive businesses: food companies that seize the initiative can benefit from a potential 15% five-year revenue uplift vs a 43% revenue decline for companies that fall behind, based on a scenario of increasingly aggressive regulation4

7. PwC’s Global Investors Survey 2023.

8. MSCI, Sustainability & Climate Trends to Watch 2024.

9. BCG, Rockefeller Foundation, 2023 Climate Finance Market Survey.

10. IEA, Critical Mineral Market Review 2030.