Our system of corporate governance promotes clarity and accountability while continuing to evolve to ensure long-term sustainable value.

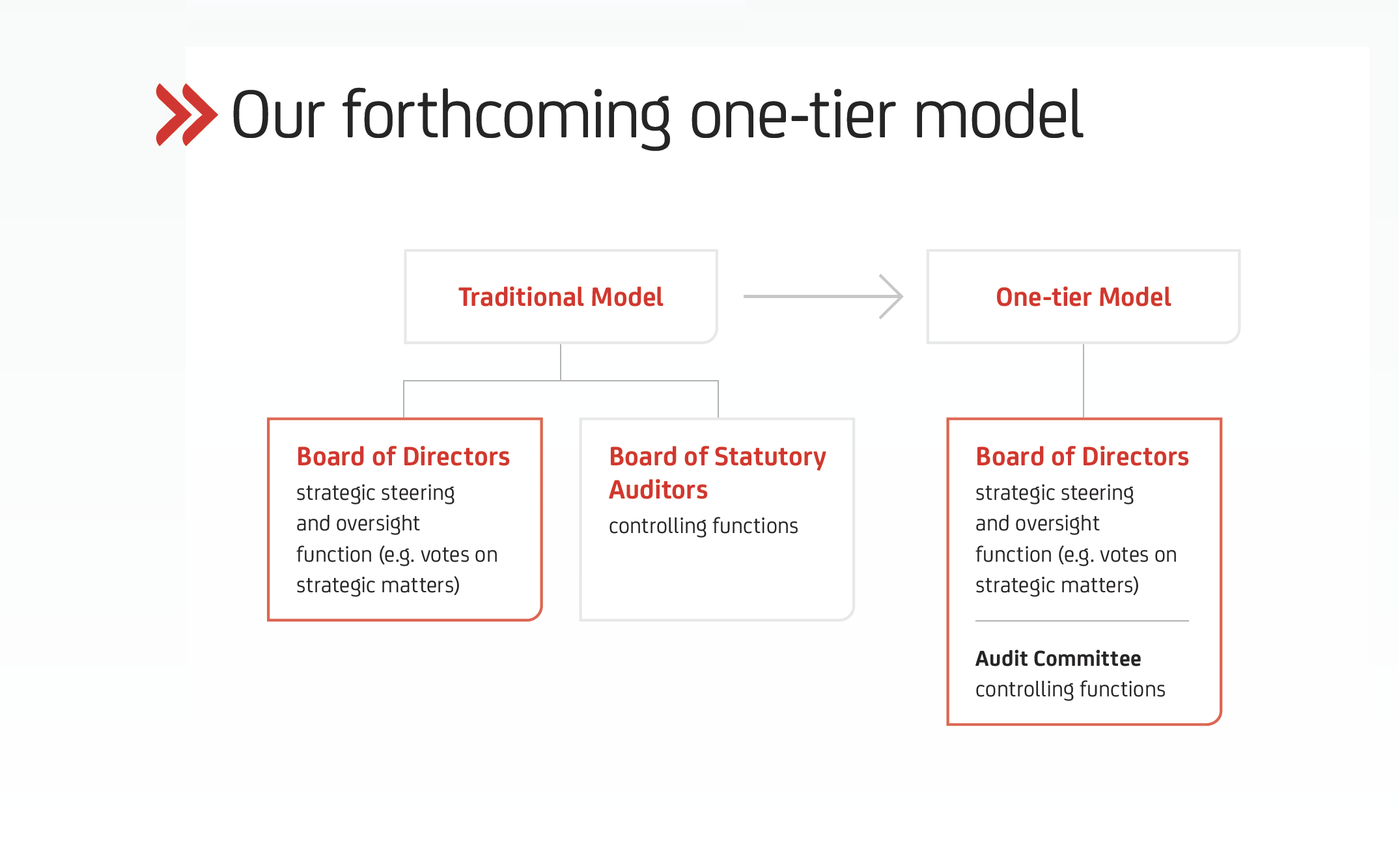

Governance model

UniCredit is an Italian listed company, with a traditional management and control system, which assigns specific responsibilities to the Shareholders’ Meeting and allows for a clear exchange of views between shareholders and management on key decisions relating to governance. These include appointing and removing Directors, appointing members to the Board of Statutory Auditors, granting a mandate for external auditing to an audit firm and approving all associated fees. Such decisions also include the approval of financial statements, the allocation of profits, resolutions on remuneration and incentive policies and practices in accordance with current provisions, as well as setting criteria to determine compensation to be granted in the event of early termination of employment or early retirement from office.1

Governance model evolution

Desirable profile and list

In line with international best practices, milestones for the upcoming renewal of UniCredit’s corporate bodies are the identification of:

- a theoretical qualitative-quantitative profile deemed to be optimal with respect to the goals outlined in the applicable rules, and

- the Board of Directors list ensuring a balanced composition of knowledge, skills and experience; promoting inclusion and diversity across age, gender and geographical areas; adequately reflecting the size and operational complexity of UniCredit Group.

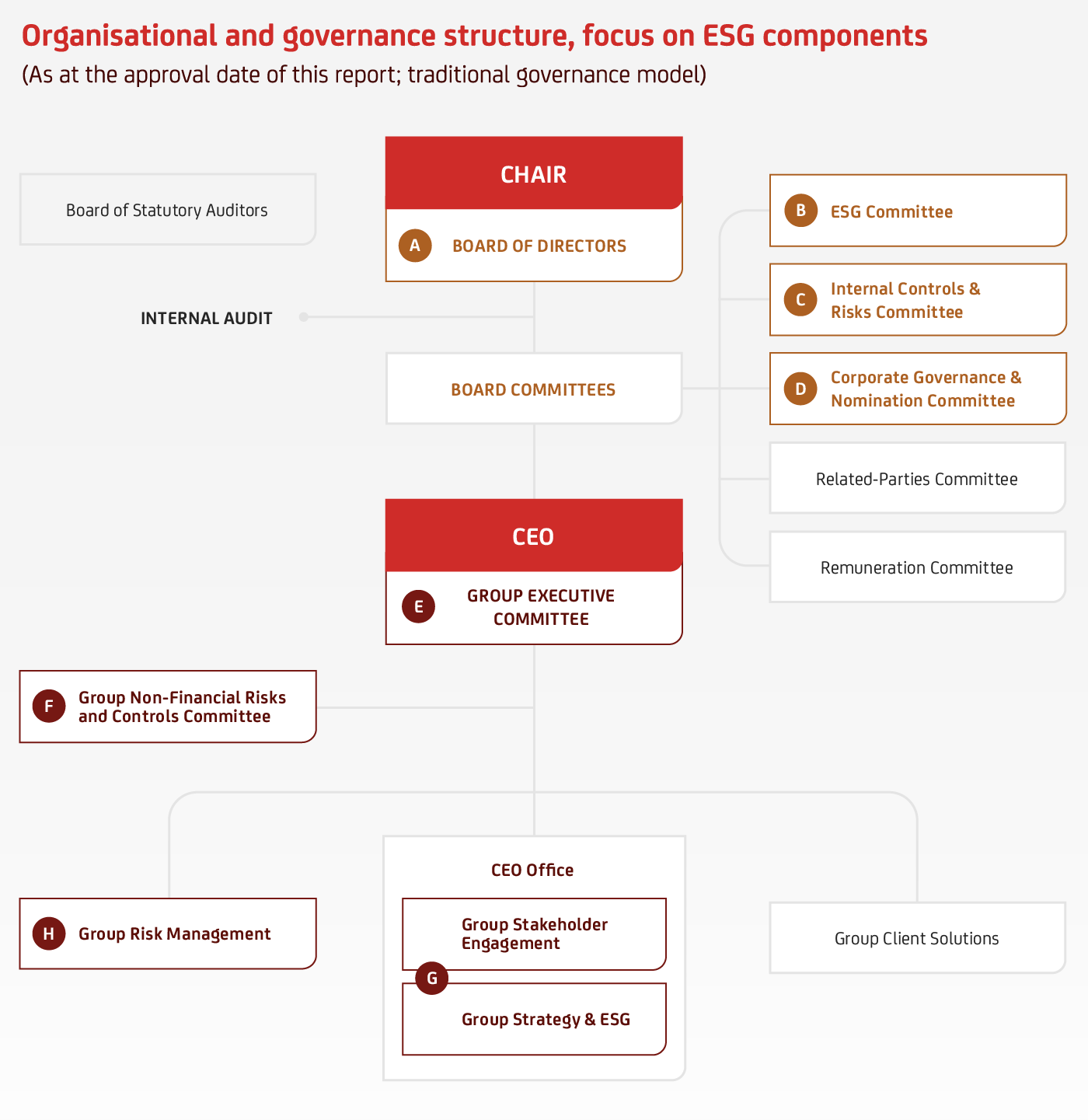

ESG Governance and management

Our sustainability governance has been significantly strengthened in recent years at both steering and execution levels, underpinning the drive to further integrate ESG criteria into the Group’s overall business strategy.2

Corporate bodies oversight

A. UniCredit’s Board of Directors defines the overall strategy of the bank, which incorporates the Group’s ESG strategy, overseeing its implementation over time.

B. The ESG Committee (ESGC) supports the Board of Directors in fulfilling its responsibilities with respect to the ESG components integral to the Group’s business strategy and sustainability over time.

C. The Internal Controls & Risks Committee (IC&RC) supports the Board of Directors in risk management and control-related issues. Its work encompasses matters of risk in the ESG sphere such as climate change risk.

D. The Corporate Governance & Nomination Committee (CG&NC) provides support to the Board on topics regarding the UniCredit corporate governance system, the Board of Directors composition and top management.

- The Board of Statutory Auditors exercises oversight of ESG governance and related topics. On the occasion of the latest renewal of the Board of Statutory Auditors, the areas of Sustainability (ESG) and Digital technology were specifically added as desirable competencies of the qualitative profile of its members.

Steering and coordination

E. The Group Executive Committee (GEC) is the Group’s most senior executive committee and is chaired by the CEO. Within its mission it defines the overall ESG strategy. It also ensures the effective steering, coordination and control of the Group business as well as the alignment of the parent company with the different businesses and geographies regarding strategic topics such as ESG issues. Moreover, in dedicated Risk sessions, the GEC supports the CEO in coordinating and monitoring all categories of risks and in steering ESG-related matters, thus granting a dedicated focus on Climate and Environmental risks among others.

F. The Group Non-Financial Risks and Controls Committee (GNFRC) supports the CEO in steering and monitoring non-financial risks. For example, it approves governance policies and guidelines for the management of reputational risk regarding sensitive sectors.

G. The Group Strategy & ESG and Group Stakeholder Engagement functions work together as a CEO Office,3 handling all important initiatives for the CEO. These initiatives include strategy development, M&A, the integration of ESG criteria into our business operations, stakeholder management and dealing with regulatory affairs.

The Group ESG function, part of Group Strategy & ESG, steers the definition and implementation of the Group’s ESG strategy. It ensures the ESG framework is consistent with the Group’s principles and Purpose and with relevant international standards4 and practices. Moreover, the function is tasked with, inter alia, developing the social agenda and related proposition, monitoring and disclosing the Group’s ESG impacts and results, and with overseeing the adoption of relevant policies and standards. The function’s activities are divided into three offices – ESG Strategy and Implementation; ESG Service Excellence; ESG Metrics, Policies and Disclosure.

H. The Group Risk Management function supports the CEO in defining the Group Risk Appetite proposal, which is to be shared with the GEC, the IC&RC and submitted for approval to the Board. This process occurs in coordination and in alignment with the yearly budget plan. The function ensures the overall climate risk framework definition at Group level and supports local implementation. Within the various risk areas, dedicated employees and functions have been devoted to the integration of climate topics within risk management activities and the effective dissemination of the relative knowledge. Such functions include Climate Risk and Risk Governance which oversees climate-related and environmental risks, and Climate & Environmental Credit Analysis which manages the integration of climate and environmental factors within the credit risk cycle.

Furthermore, the Group Risk Management functions issue, for related competent topics, credit risk opinions to support the Group Transactional Committee sessions in the discussion and approval (based on the delegated powers) of credit transactions.

Implementation and execution

Dedicated ESG teams and experts. ESG matters are embedded across our Group through dedicated teams and experts in several Group functions which manage ESG topics in line with their areas of competency. Examples include the ESG Advisory team, ESG offices supporting business divisions in the main Group geographies, and the ESG Digital and Group Real Estate ESG, Innovation Projects & Monitoring functions.

The Compliance and Regulatory Affairs functions also have resources dedicated to ESG-related issues.

Additionally, an important role is played by UniCredit Foundation, the corporate foundation of UniCredit Group. Its Purpose is to unlock the potential of Europe’s next generation. The Foundation’s mission is to empower young people across Europe by providing equal opportunities in education and supporting their personal and professional development.5

1. For more information refer to the annual Report on corporate governance and ownership structure and the 2024 Group Remuneration Policy and Report available in the Governance section of our website (www.unicreditgroup.eu/en/governance.html).

2. For more information on functions involved in the governance and management of climate-related issues, see our 2022 TCFD Report, pages 11-16, available at https://www.unicreditgroup.eu/content/dam/unicreditgroup-eu/documents/en/sustainability/sustainability-reports/2022/ UC_TCFD_TOT_2022_ENG.

3. Also includes the Group CEO Staff.

4. This includes the coordination and publication of the Group Integrated Report, UniCredit’s TCFD Report, the implementation of the Principles for Responsible Banking-UNEP FI and related reporting. Moreover, the function co-coordinates the Group’s conversion project towards implementation of the Corporate Sustainability Reporting Directive (CSRD) together with the Group Finance function.

5. For more information refer to the Social and Relationship chapter and to the website of the Foundation https://www.unicreditgroup.eu/en/ microsites/unicreditfoundation.html.