UniCredit acted as Equity Private Placement Advisor to D-Orbit in the context of the €100 million+ first closing of its Series C funding round. This represented the largest equity private placement in Italy in 2023 and a landmark transaction in European private capital markets.

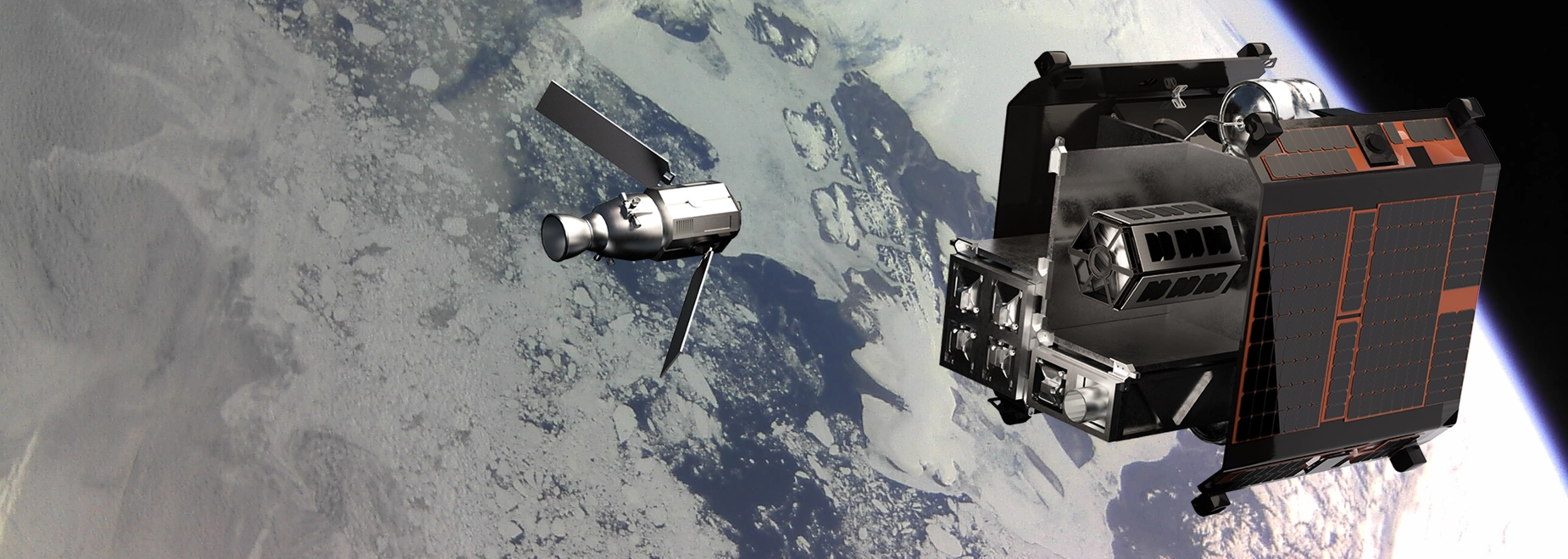

Founded in Italy in 2011, D-Orbit is a market leader in the space logistics and orbital transportation services industry with a track record of fifteen missions completed and 140+ payloads brought into space to date. The company directly addresses the logistics needs of the space markets via its ION Satellite Carrier, which can release satellites individually into distinct orbital slots – reducing the time to operations by up to 85% and the launch costs by up to 40%.

D-Orbit’s vision is to create the logistics infrastructure that will power the future in-orbit economy by enabling the sustainable transportation of goods, information and people in space.

Thanks to the close collaboration between our Alternative Capital Markets and Ultra-High Net Worth teams, we played a leading role in the transaction – bringing the largest follower investor in the round, as well as ensuring the first closing happened by the end of the year, a key priority for management.

As ever, our capital markets competences, strategic dialogue and unparalleled equity distribution capabilities came to the fore in driving a successful outcome.

Proceeds from the investment round will fuel the continued expansion of D-Orbit’s space-logistics service offering in areas such as in-orbit satellite servicing and space cloud computing, whilst also helping to reinforce D-Orbit’s operational capabilities across the US, Europe and United Kingdom.

This milestone marks a seismic leap in our company’s evolution. Our profound gratitude not only goes to every investor in the round but also UniCredit, who expertly supported the process from start to finish.”

CEO of D-Orbit

Our support for D-Orbit not only signifies the depth of the content we can bring to clients around emerging, high-growth sectors, but also our ability to execute and attract private capital across a wide and diversified investor base.”

Director – Alternative Capital Markets