Dear Stakeholders,

2023 was the best year in UniCredit’s history and the crowning achievement of our first three years of transformation.

It will be remembered as the year we surpassed the targets we set at UniCredit Unlocked, and emerged as a better, stronger bank as a result. One capable of being the bank for Europe’s future.

We are no longer a bank that settles for less. We have built a culture of excellence that puts our clients at the centre and prioritises long-term value creation over short-term gain.

This has been driven by a cultural and industrial transformation, which has redefined the way our bank operates. Before, there was no ‘one UniCredit’. There were 13 disparate banks that lacked common principles, values and a clear strategy and were falling short of their potential.

Now our bank is united behind one vision, with all its parts operating in lockstep with the interests of the Group and Europe as a whole. A model that now empowers our people and gives our clients what they are asking for.

2023 was truly the year we came together behind one purpose and vision and executed an ambitious strategy that has propelled us from a laggard to a leader.

2023 was a remarkable year and the product of three years of transformation. There will no doubt be challenges ahead in 2024, but I am confident in the direction our bank is taking."

Surpassing our targets

Despite a challenging macroeconomic backdrop, 2023 was the year we surpassed targets that some thought impossible a year ago.

We achieved a RoTE of 16.6% (20.5% when correcting for the excess capital that we carry at 13% CET1).

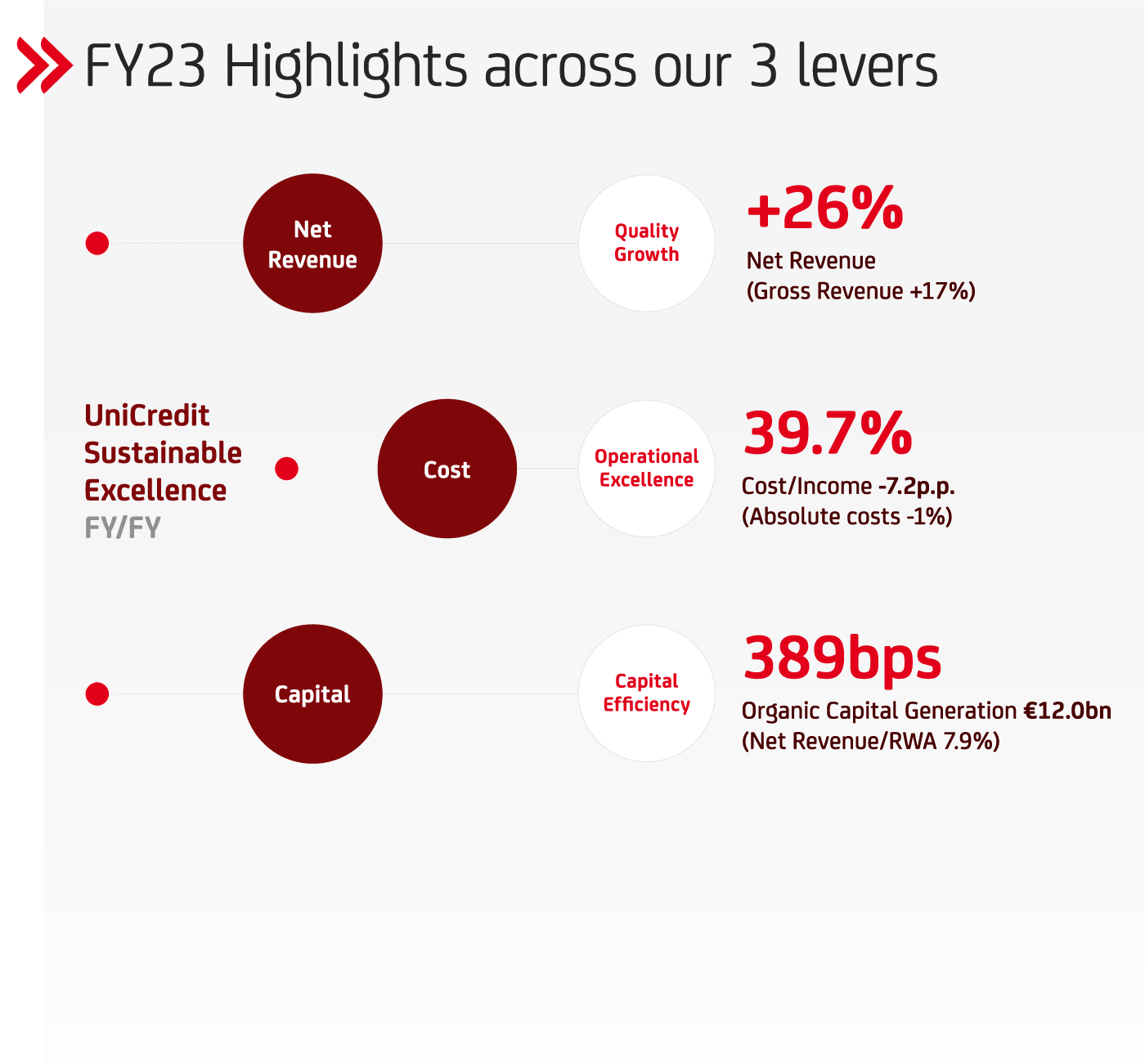

Our net revenues stood at €23.3 billion – an increase of 26% year on year. This was mostly driven by exceptional net interest income and resilient fees while maintaining a low cost of risk.

We have enhanced our three product factories – corporate solutions, payments solutions, and individual solutions – to deliver best-in-class products for our clients at scale. As a result, our factories generated €9.9 billion in 2023, down 2% despite challenging market conditions.

We are now in our twelfth quarter of year-over-year profitable growth driven by outperformance across each of our three core financial levers, achieving the best results in UniCredit’s history.

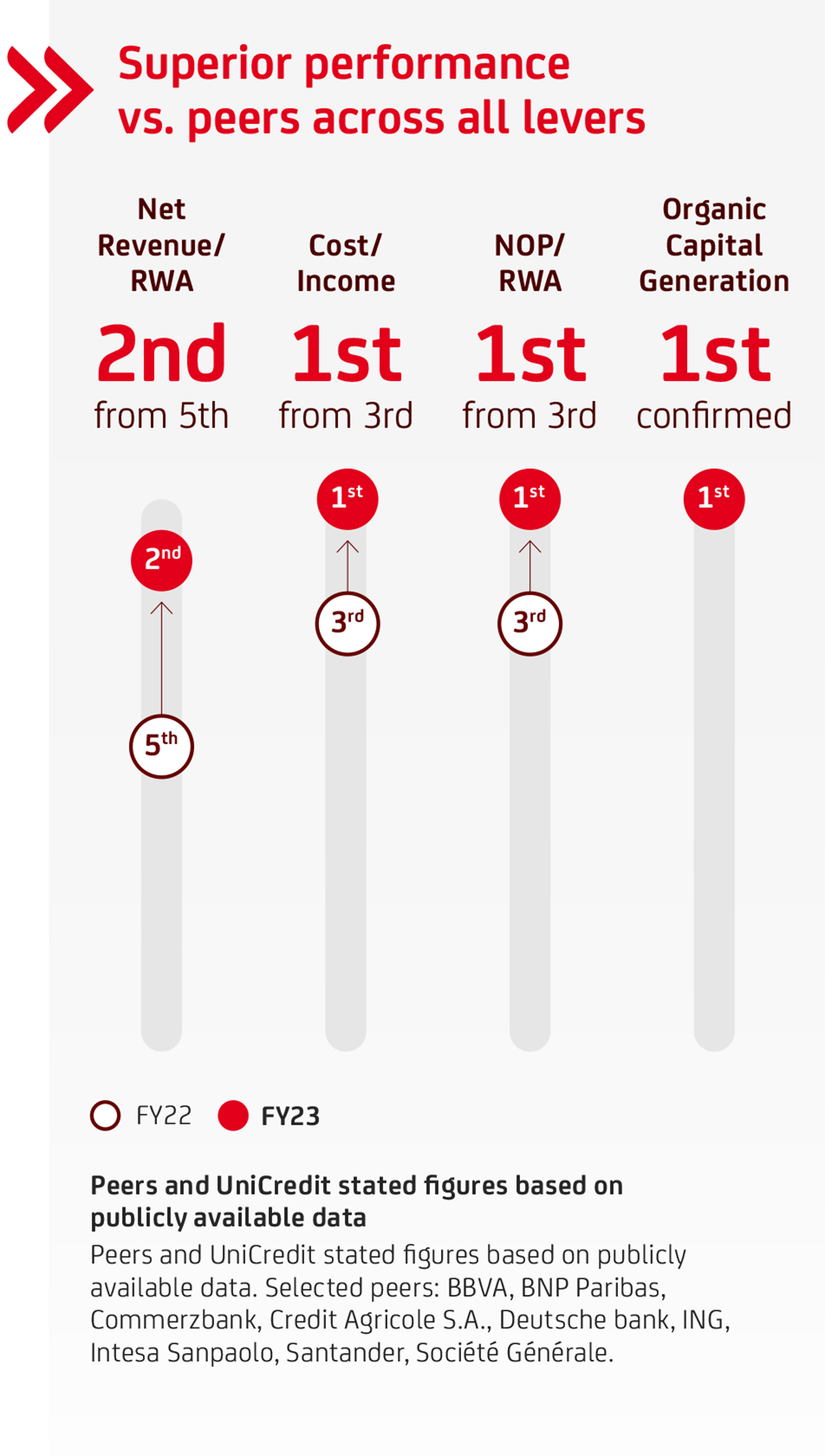

In comparison to our peers, we have best-in-class top-line growth, operating efficiency, and unrivalled organic capital generation. We have one of the highest CET1 ratios, one of the highest RoTE (the highest when corrected for our excess capital at 13%), quality credit portfolio and coverage, and the highest forward-looking precautionary overlays.

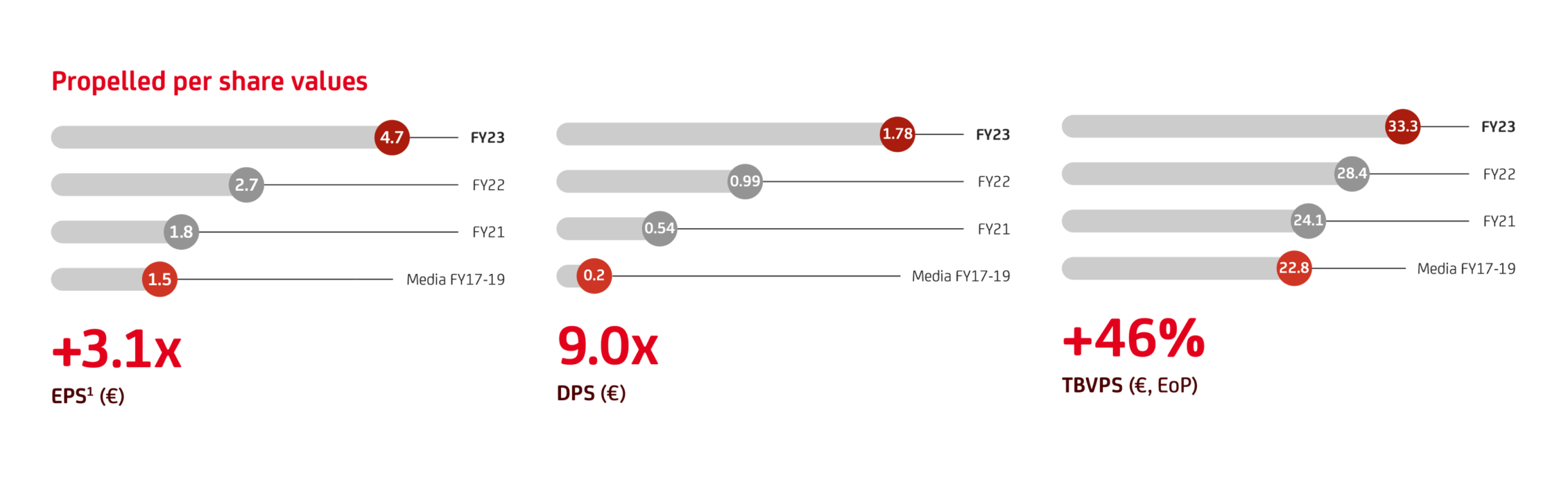

After three years of transformation, our RoTE has tripled, our net profit is over 2.5x compared to 2017-2019 averages1, and we have delivered over €27 billion in organic capital generation. We distributed €17.6 billion over three years, which is equal to our market cap at the beginning of 2021.

This year alone we have generated €12 billion in capital organically, underpinning our proposed distribution of €8.6 billion (100% of net profit) in the fourth quarter – €3.0 billion dividends and €5.6 billion share buyback – while reinforcing our CET1 ratio by c.100 basis points to 15.9%.

In 2023 we delivered on the €5.25 billion commitment made in our FY22 shareholder distribution programme, and front-loaded the execution of a €2.5 billion share buyback as part of the FY23 distributions.

At the same time, per-share value creation has reached even greater heights, more than tripling EPS versus our historical run-rate, with DPS nine times higher, and tangible book value per share up almost a half.

The financial targets we have met and exceeded have not been at the detriment of our ESG commitments, which are embedded firmly in our business model.

With a unique pan-European footprint, we have a responsibility to pursue a fairer, greener future.

We remain steadfast in our commitment to reach net zero by 2050 and in 2023, we became a single-use plastic-free bank and lent €7.6 billion in environmental loans.

The Social dimension of ESG continues to be a priority for UniCredit, and we are leading by example with €3.8 billion of social financing and €60 million of social contribution.

1. For comparison purposes the FY17-19 net profit is the simple average of Net profit recast figures for Group excluding Turkey and Fineco.

Our winning approach continues

1. Net Profit for FY22 and FY23 is stated net profit adjusted for impacts from DTAs tax loss carry forward resulting from sustainability test. The result is used for cash dividend accrual / total distribution. Underlying net profit for FY21. For comparison purposes the FY17-19 net profit is the simple average of Net profit forecast figures for Group excluding Turkey and Fineco.

There will no doubt be challenges ahead in 2024, but I am confident in the direction our bank is taking.

2023 was a remarkable year and the product of three years of transformation.

Every target we’ve set, we’ve exceeded, and now we are a leading European bank that is delivering consistently for its stakeholders. This would not have been possible without the belief, trust and hard work of thousands of people who work at UniCredit.

Our challenge now is to go beyond these record results and continue the performance of the past three years.

We must work to sustain our winning approach, defend our record financial performance, and set the stage for the next phase of UniCredit’s growth.

We are now a leader in banking and we aspire to become champions. I have no doubt in our ability to do this.

Yours,

Andrea Orcel

Chief Executive Officer UniCredit S.p.A.